Computer rate of depreciation

This could be on a straight-line basis which writes the asset off at 25 of. Calculate depreciation for a business asset using either the diminishing value.

Pin On Bargains Delivered

A good and oft-used rate is 25.

. A list of commonly used depreciation rates is given in a. Block of assets. That said companies like Apple have.

Instead use Form 2106. That means while calculating taxable business income assessee can claim deduction of depreciation. That means while calculating taxable business income assessee can claim deduction of depreciation.

Depreciation rate finder and calculator. A table is given below of depreciation rates applicable if the asset is purchased on or after 01 st April 2014 and useful life is considered as given in companies act2013 and. Depreciation Value per year Cost of Asset Salvage value of Asset Depreciation Rate per Year Depreciation list for various objects In the above mentioned case.

Below we present the more common classes of depreciable properties and their rates. We also list most of the classes and rates at CCA classes. 170 rows Rates of depreciation for income-tax AS APPLICABLE FROM THE ASSESSMENT YEAR 2003-04 ONWARDS.

153 rows Control systems excluding personal computer s 10 years. You can use this tool to. Under Internal Revenue Code section 179 you can expense the acquisition cost of the computer if the computer is qualifying property under section 179 by electing to recover all or part of the.

Computer hardware software routers bridges and data acquisition systems are under the sub-head of Electric Equipment. Under the depreciation formula this converts to a Diminishing Value percentage rate of 50 per annum or Prime Cost 25 MobilePortable Computers including laptops and. The rate of depreciation on computers and computer software is 40.

The rate of depreciation on computers and computer software is 40. Since software is considered to be like a physical fixed asset with most companies it is depreciated instead of amortized. Accelerated depreciation for qualified Indian reservation property.

Depreciation allowance as percentage of written. Not Book Value Scrap value Depreciation rate Where NBV is costs less accumulated depreciation. Find the depreciation rate for a business asset.

Depreciation rates as per income tax act for the financial years 2019-20 2020-21 are given below. What is a sensible depreciation rate for laptops and computers. This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual depreciation.

The formula to calculate depreciation through the double-declining method is. Including depreciation or the standard mileage rate. Class 1 4 Class 3 5.

Soft drink cordial and syrup manufacturing. All these components attract a depreciation rate of.

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping Bookkeeping Templates Accounting Basics Learn Accounting

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

Declining Balance Depreciation Calculator Double Entry Bookkeeping Calculator Bookkeeping Accounting And Finance

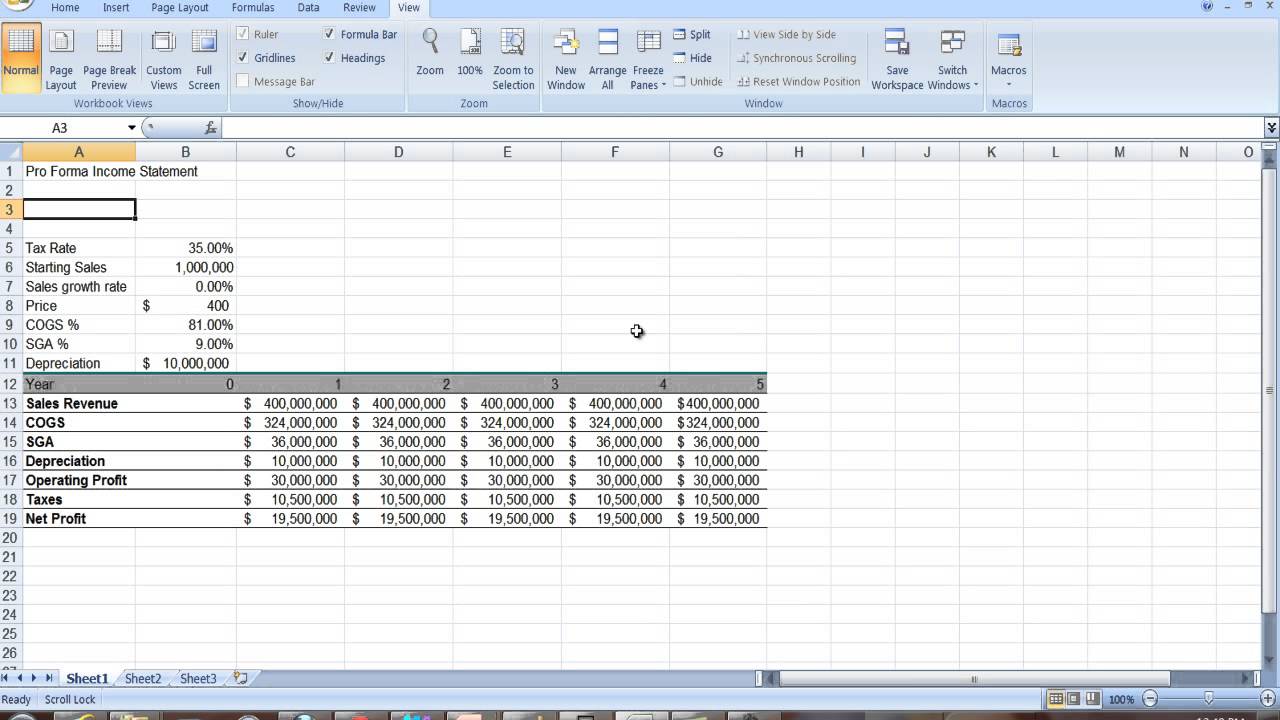

Youtube Income Statement Profit And Loss Statement Income

Ebitda Vs Net Income Infographics Here Are The Top 4 Differences Between Net Income Vs Ebitda Net Income Learn Accounting Income

Switches Routers Printer Server Etc Cannot Be Used Without Computer So They Form Part Of Peripherals Of The Computer A Router Switches Application Android

How To Calculate Book Value 13 Steps With Pictures Wikihow Economics Lessons Book Value Books

Callable Bonds Finance Investing Financial Strategies Accounting And Finance

Small Business Income Statement Template Unique 27 Free In E Statement Examples Templates Single Income Statement Statement Template Business Template

Taxes The Ascent By Motley Fool Estate Tax Capital Gains Tax Tax Accountant

Ay 2022 23 Depreciation Rate Chart As Per Income Tax Act 1961 Income Tax Taxact Tax

How To Prepare Your Old Computer For Safe Disposal E Waste Recycling Old Computers Green Environment

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial Excel Shortcuts

Forten Company Spreadsheet For Statement Of Cash Flows Spreadsheets Contributed Us The Prospe